Blog

iGPS Quarterly Report – 2024 Q1

Click here for our investment monitoring report for the 1st quarter of 2024.

How iGPS Creates a Data-Rich, Highly Personalized TDF for Your Clients

Personalized investment strategies and retirement plans have often seemed out of reach and complicated for the average American worker. The challenges ranged from prohibitive costs and...

Why Choose iGPS Retirement Solution?

Most employer-sponsored retirement plans use a traditional Target Date Fund (TDF) today. A lack of personalization and customization can lead to significant misalignment of investment risk, return,...

iGPS improves on TDF 1.0 through Big Data

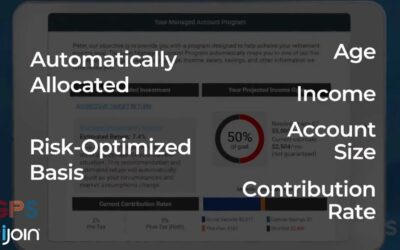

iGPS is a personalized target-date fund solution, which relies on workers' individual data such as age, income, savings rate, employer match rate, account balance, and projected Social Security...

Personalization In Retirement Is A Must-Have

Personalization in retirement investing is not just something that would be nice to have but is something that we need to have. We can equate that to buying readers, the reading glasses at the local...

iGPS Personalizes With Big Data

Currently, a target-date fund, or TDF, is used as the default for a retirement plan. The current target-date fund is very popular because of a few reasons: It is simple to understand. It is low...

Personalization is Precision

At iGPS, we think about personalization in the following way: landing on the moon. To land on the moon, you must be very precise and exact. Even one-one thousandth of a degree off from the beginning...

Helping Produce Better Retirement Outcomes with Personalized TDFs

Managed accounts offer customization in your investments, but come with high fees and required personal engagement.

What Are The Benefits Of A Managed Account?

Managed accounts offer customization in your investments, but come with high fees and required personal engagement.

What Is A Target Date Fund?

A target date fund is an investment where a participant is invested in multi-asset portfolios based on five-year cohorts. iGPS makes these personalized, narrowing down your investments specific to you and not your five-year cohort.

Select the “Right” Managed Account Service is a Fiduciary Duty

On August 11, 2022, a class action suit was filed against the Dover Corporation to include the Dover Company Benefits Committee for breaching their fiduciary duty of prudence owed to the Dover...

Target Date Fund is the New Fiduciary Target

On August 2, 2022, a class action suit was filed against the 401(k) Administrative Committee of the Microsoft Corporation Savings Plus Plan. The Plan assets were valued at $38.34 billion...

Personalize Your Retirement Plan

iGPS gives you the benefits of a personalized managed account without the high fees or constant engagement.

iGPS – A Case for Personalization

The Congress, on May 6, 2021, issued a letter[1] to the GAO, stating “[t]he employer-provided retirement system must effectively serve its participants and retirees, and we are concerned certain...

iGPS is now available on iJoin’s MAP Marketplace

“An evolutionary offering that changes the landscape for QDIA” LDI-MAP (d.b.a. iJoin) and Nexus338 announced today the launch of iGPS on iJoin’s Managed Account Marketplace. Nexus338’s iGPS...