Resources

Learn more about your options for retirement solutions.

Managed

Accounts

QUALIFIED DEFAULT

RETIREMENT ALTERNATIVE

Target Date

Funds

Managed

Accounts

Q. What is an in-plan Managed Account?

A. A Managed Account is an investment and advice platform connected to a retirement plan’s recordkeeping service to provide employees with a personalized retirement investment solution. In an increasingly noisy and complex world, employees are juggling short-term priorities and left with little time to focus on their long-term financial security. A Managed Account is a digital advice and automated investment solution to effectively assist employees in personalizing goal-based savings and investing for retirement.

Q. How can Managed Accounts help?

A. A Managed Account is designed to make it easier for employees to prepare for retirement. Typically, basic information for each employee enrolled in a Managed Account is provided by the plan’s recordkeeper. Employees interact through a series of questions and responses. Employees may add additional data (such as non-plan assets, IRA values, defined benefit income at retirement, etc.) and information (expected retirement age, the state of residence during retirement, etc.) to provide a more complete profile. The portfolio construction algorithm selects the appropriate portfolio for each employee and thereby tailors an individualized portfolio to better meet the employee’s unique circumstance and long-term objectives. The portfolio can be implemented by using the retirement plan’s core menu options or a set of dedicated investment options made available only under the managed account option.

Q. How a Managed Account differs from a target-date fund (TDF)?

A. When an employee selects or defaults into a target-date fund, it is one fund along a continuum of related funds that best corresponds to the employee’s expected retirement date at age 65. The single TDF has been created by an investment manager based on a set of broad assumptions that are likely to be applicable to an “average” worker within that cohort. A TDF places emphasis on a single factor age. But a worker’s age is only relevant for the investment time horizon. Using a TDF is equivalent to saying that everyone born in the same year as you should all be invested the same way without variations. A Managed Account, on the other hand, creates personalized portfolios based on the information you provide and that is made available by your plan’s recordkeeper. Your engagement with the Managed Account advice engine focuses all recommendations specific to you.

Q. Is a Managed Account solution a qualified default investment alternative (QDIA) for plans?

A. Yes, a Managed Account can be a QDIA. The employer must stick to the required process for selecting and monitoring the Managed Account provider as well as meeting all notice requirements to gain the fiduciary safe harbor benefit.

Q. How does the Managed Account Solution meet employers’ required fiduciary obligations under ERISA?

A. The fiduciary manager to the Managed Account typically acts in the capacity of a fiduciary on the allocation algorithm and to each employee’s account. What this means is that the fiduciary manager has the duty to serve in the Best Interest of each worker without conflicts.

Q. What is the cost to provide a Managed Account Service?

A. To deliver the combination of portfolio construction algorithm, digital advice, and the fiduciary oversight required, there is a Managed Account charge that is above and beyond the investment fee assessed by the underlying investments. Further, there is typically an additional fee payable to the recordkeeper to connect with and fulfill the investment activities for the Managed Account service. Typically, the asset-based fee (depending on the number of employees and the expected account size) varies from 0.2% to 0.6% per year.

QUALIFIED DEFAULT

RETIREMENT ALTERNATIVE

Q. What is a Qualified Default Investment Alternative (QDIA)?

A. The final 2007 QDIA regulation extends a safe harbor process for plan fiduciaries to invest employee and employer contributions when the participant does not provide affirmative investment direction. The QDIA legislation provides plan sponsor and fiduciaries the confidence to nudge employees to save for retirement and to invest contributions under the following circumstances:

1. Auto-enrollment

When a plan auto enrolls employees, the employer can invest the ongoing contributions from employees and employers in the plan’s default investment option without the need to receive an affirmative investment instruction from employees.

2. Changing investment options

When a plan option is terminated or removed from a self-directed defined contribution plan, such as a 401(k) or 403(b) plan, the liquidated proceeds from the terminated fund can be invested in the default invest option unless participants have provided affirmative investment instructions.

Q. What are types of Qualified Default Investments?

A. The final regulation provides for three types of investments that would be deemed QDIAs. They are summarized as follows:

1. RISK-BASED – A multi-asset investment product that takes into account the characteristics of the group of employees “as a whole” (e.g. a balanced fund)

2. AGE-BASED – A multi-asset investment product that takes into account each participant’s “age” (e.g. a target-date fund)

3. PARTICIPANT-BASED – An investment management service that allocates contributions to provide an asset mix that takes into account the participant’s age and other factors (e.g. a managed account service) but is not required to take into account risk tolerances, investments or other preferences of an individual participant.

Q. What is Fiduciary Relief Safe Harbor?

A. To receive fiduciary relief, the following summary actions must be adhered to:

1. Plan sponsor must prudently select and monitor any qualified default investment alternative under the plan

2. Participant assets are invested in a qualified default investment alternative

3. Participants had the opportunity to direct their investment of the assets

4. Participants are furnished a notice of default investment at least 30-days in advance and at least 30-days in advance of each subsequent plan year

5. Participant may transfer, in whole or in part, such assets to any other investment options available under the plan

Target Date

Funds

Q. What is a Target Date Fund?

A. The final 2007 QDIA regulation extends a safe harbor process for plan fiduciaries to invest employee and employer contributions when the participant does not provide affirmative investment direction. The QDIA legislation provides plan sponsor and fiduciaries the confidence to nudge employees to save for retirement and to invest contributions under the following circumstances:

Q. Why are Target Date Funds so popular?

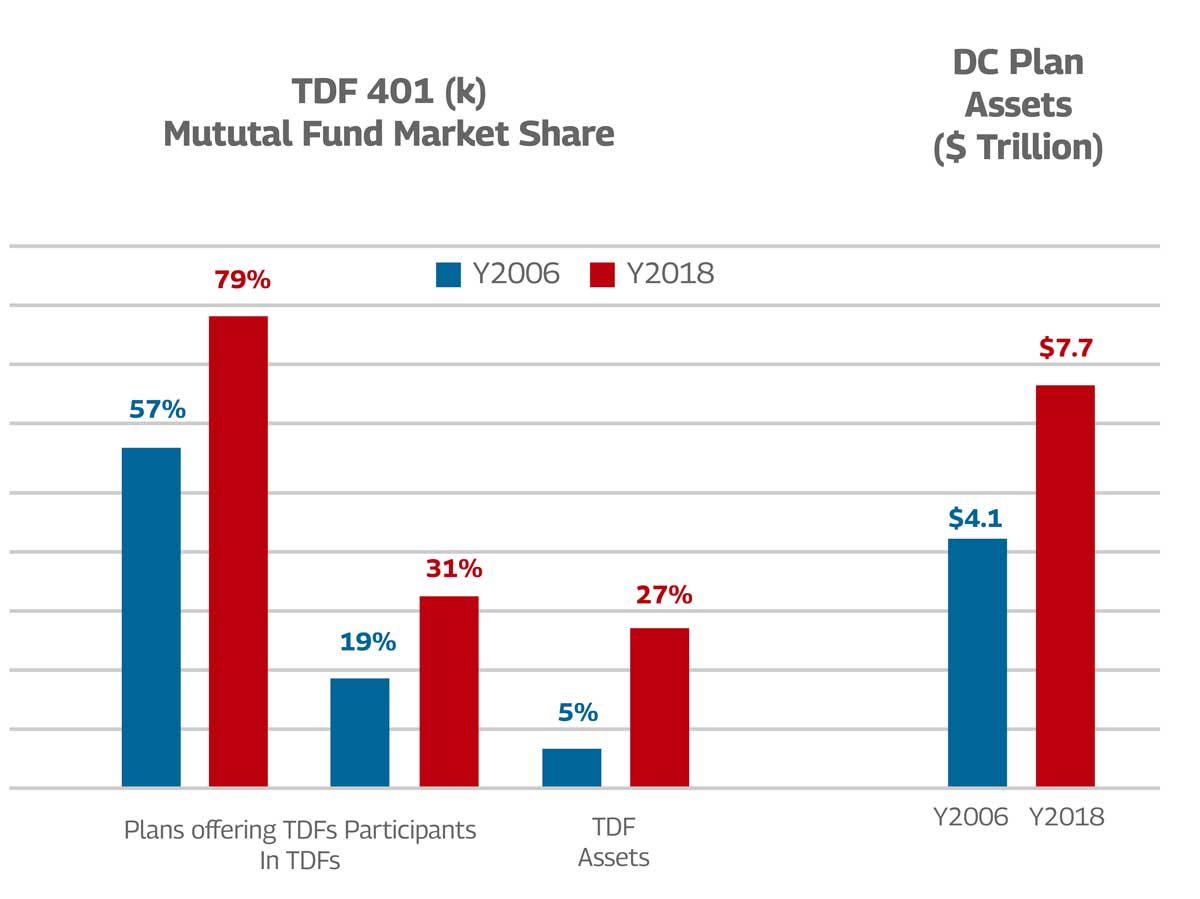

A. Since the Pension Protection Act of 2006 codified the concept of Qualified Default Investment Alternatives (QDIAs), which provides fiduciary safe harbor for plan sponsors to default retirement participant investments, the popularity of target date funds (TDFs) has skyrocketed.

3 REASONS FOR TARGET DATE FUND POPULARITY

1. Simplicity – A number of risk-based portfolios are strung together that gradually reduce risks (stock exposure) along a glide path towards retirement. This “set-it-and-forget-it” approach requires no active involvement by participants and is easy to explain to and understand by plan fiduciaries.

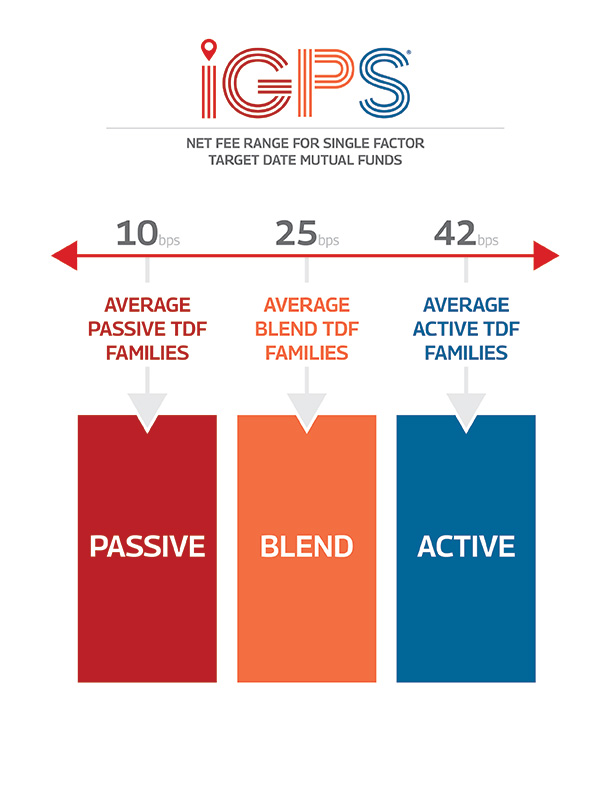

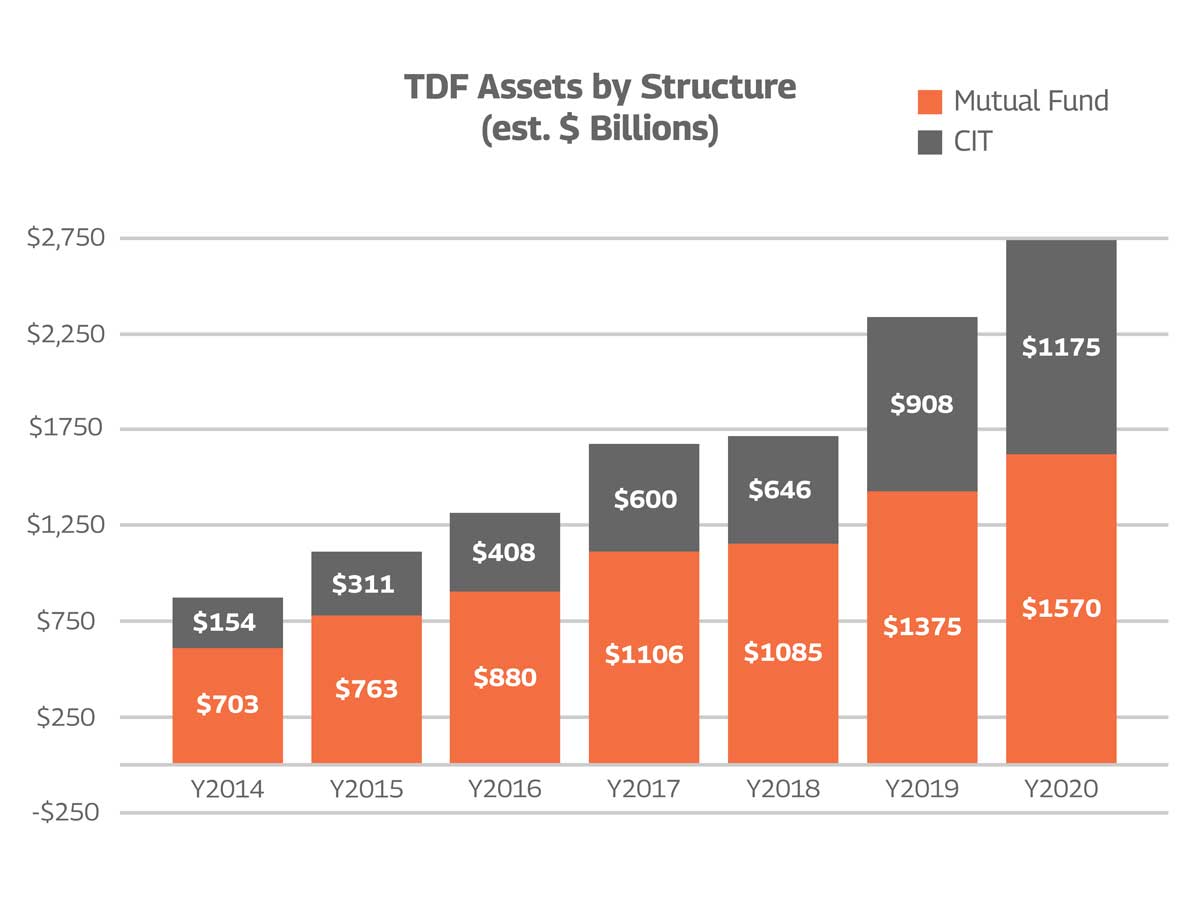

2. Low Cost – Over the last decade, TDFs have lowered investment expenses by (a) blending active (higher cost) with passive (lower cost) investment options and (b) shifting from mutual funds (higher cost structure) to CITs (lower cost structure).

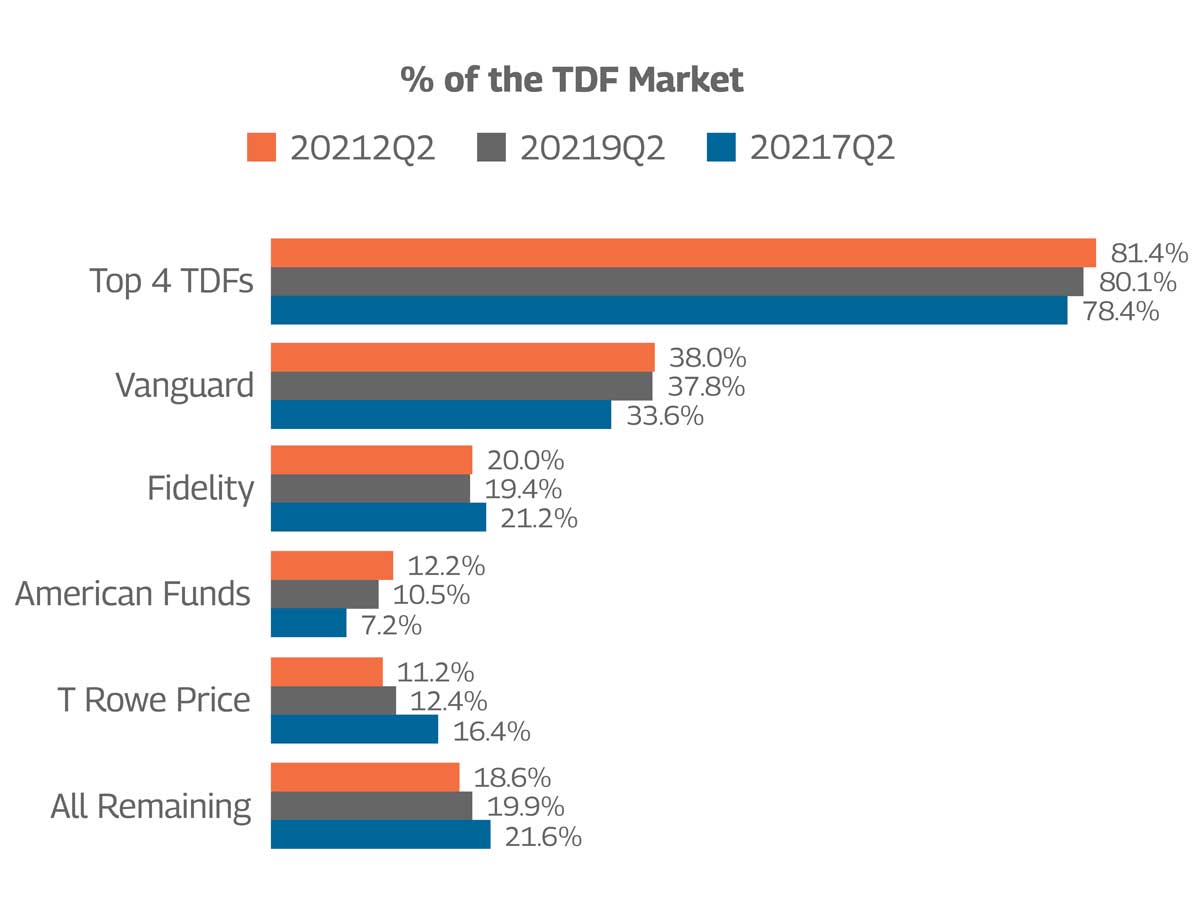

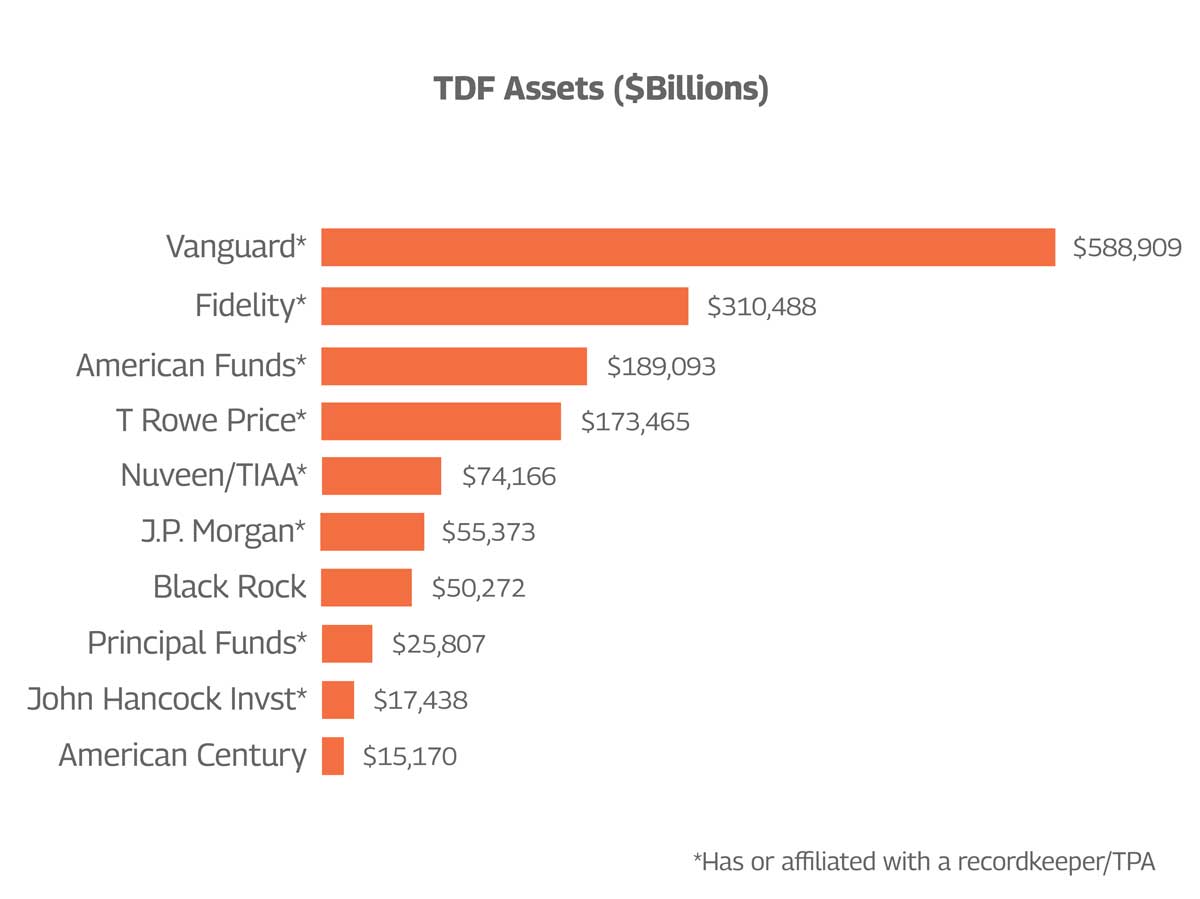

3. Connectivity – The top 5-TDF providers are all affiliated with or have a subsidiary providing recordkeeping services to retirement plans. This connectivity (both business and technology) provides a natural distribution access to retirement plans – a significant advantage.

Q. Why are Target Date Funds one-size-fits-all?

A. A SIMPLE BUT IMPERFECT SOLUTION – RISK & RETURN Eight most popular TDF glide paths (risk allocation) are illustrated here and clearly show a difference of equity allocation of more than 10% for the youngest participants (workers born between 1993 and 1997), over 14% difference for those 5-years from retirement (1958 to 1962) and over 21% difference for those oldest and in retirement (1933 to 1937). Which glide path is the right one for an employer group? Most fiduciary advisors suggest the glide path that is most suitable for the “average” employee would be the “right” one for all. We can and should do better than this!