Why Choose iGPS?

is the ideal QDIA for plan sponsors and participants.

is the ideal QDIA for plan sponsors and participants.

It’s personalized, simple, and low cost.

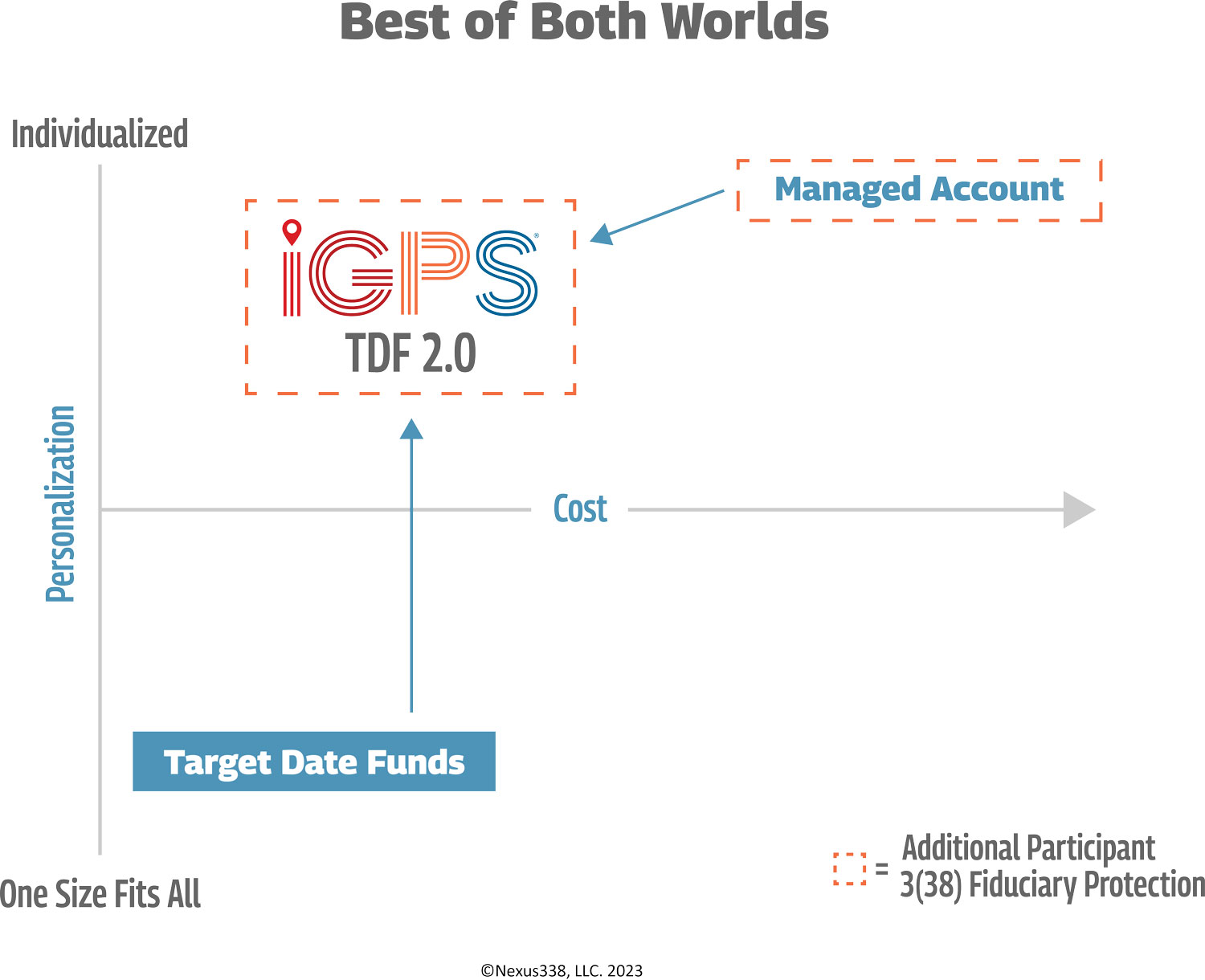

Combining the best of a Target Date Fund (TDF) and a Managed Account, individual investments are better positioned than in a one-size-fits-all TDF. Employees benefit from a much more affordable, professionally tailored portfolio compared to a high-cost, high-engagement Managed Account. iGPS offers a TDF 2.0.

What is the Rationale behind  ?

?

IT IS TIME FOR A LEAP FORWARD!

iGPS is a cost-controlled, intuitively elegant investment solution for employers who seek to do the best for their employees; while providing an extra layer of fiduciary protection.

Yes…we can now do better than a one-size-fits-all TDF!

Many new cars today are equipped with radars to sense, cameras to see, and other technologies to assist the driver in adjusting and recalibrating for a safer and more secure trip. But even with sophisticated automation, a driver still has to make sure there is enough gas or battery power to go the distance and to maintain all the parts of the car and tires in good order to ensure timely arrival. It is a combination of machine and driver to reach the destination.

In a similar manner, iGPS improves the sufficiency of retirement savings by placing sensors and other best practice boundaries to place employees on their individual path to retirement. Based on plan data available on each employee and the capital market performance, iGPS adjusts and recalibrates employee savings to stay on track. This is a significant improvement from a single-factor Target Date Fund. iGPS is a TDF 2.0! Additionally, employee engagement with iGPS guidance tools is encouraged to further align the probability of retirement success.