Advisors

What Are the Benefits to the Advisors?

FULFILLING FIDUCIARY DUTIES

Under ERISA Section 404a-1(a), a fiduciary shall discharge that person’s duties with respect to the plan solely in the interests of the participants and beneficiaries, for the exclusive purpose of providing benefits to them. iGPS can better meet these duties than TDFs through personalization.

DEMONSTRATE VALUE

With access to participant-level data, customized plan-level aggregated reports can be designed by you for plan sponsors to be more informed about how you improve plan health through better participant behavior – savings and participation – which positively impact outcome in the long-run.

DATA TRANSFORMS

In meeting these sole interest and exclusive purpose requirements, a fiduciary advisor needs access to real time data. iGPS data transparency, on the iJoin managed account platform, enables and transforms how you assist participants in meeting their retirement income objectives while helping plan sponsors to be more informed fiduciaries.

PERSONALIZATION IS THE STARTING POINT

iGPS begins by taking participant data on the recordkeeping system and individualizes a portfolio for each defaulted participant. A retirement goal success calculation is performed for each active plan participant to set the baseline. Over time, you will be able to track the progress of goal success for each participant and for plan success on the aggregate.

ENGAGEMENT

Participants who want to actively engage in the planning process rather than defaulting may always do so. The iJoin managed account platform takes in additional data and information from the participant to gain a more complete financial view. This information is then captured by the iGPS asset allocation engine to further refine the investment portfolio.

EFFICIENCY AND DIFFERENTIATION

You will have a consolidated view of all your plans on the iJoin managed account platform. This allows you and your firm to better strategize your services, define your value and to provide a way to differentiate yourself from competitors.

ROLLOVER

A terminated employee’s account with a balance of up to $5,000 may be distributed or rollover to a default IRA account. You would be on the front line to assist. There are participants with higher balances who have simply forgotten about the account over time. They are identified and you may reach out and help them examine if leaving the assets in the plan is the best solution. This level of transparency adds value to participants and the Plan.

TARGETED COMMUNICATION MADE EASY

Access to real time participant data enables you to first understand the goal success of each participant. Data Analyzer (recordkeepers who turn on this iJoin feature) connects to the built-in Email Campaign Builder that enables you to send personalized messages to nudge every participant in every plan with just a few clicks. Through participant segmentation by age, salary and account value, target specific messages to drive financial wellness and education. This keeps you connected by placing you at important moments in their financial lives.

How Does the iGPS Process Work?

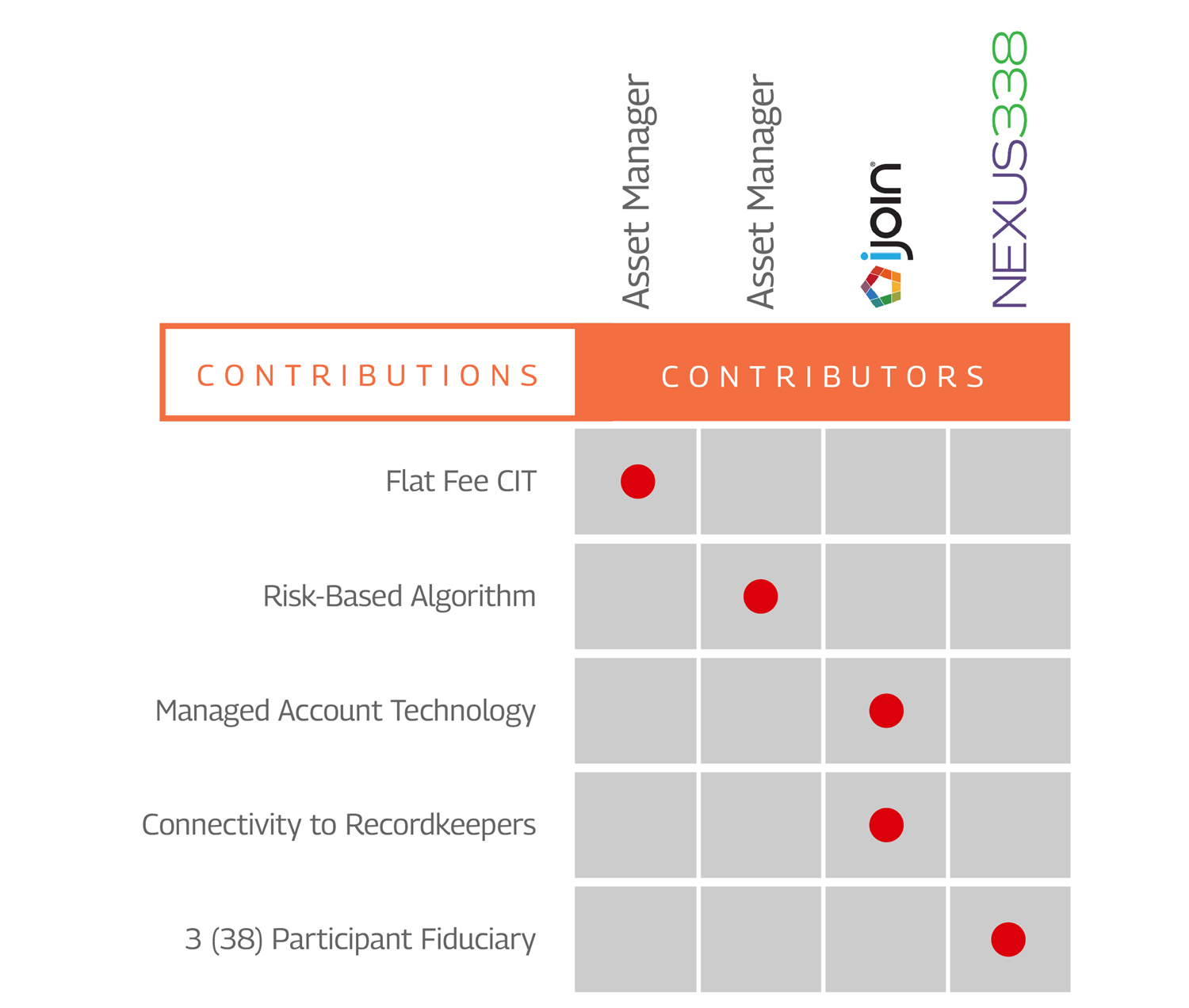

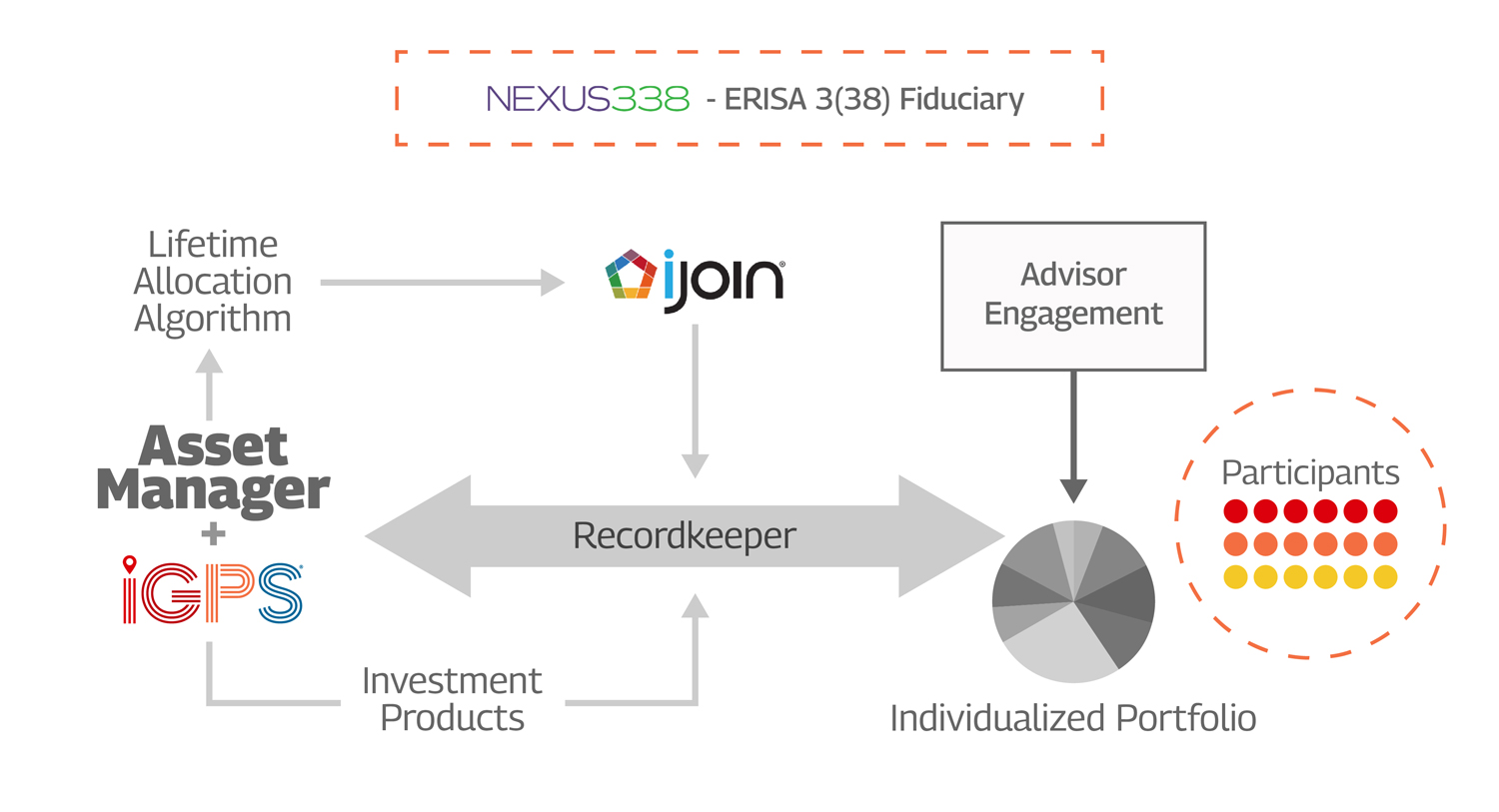

• Provides asset allocation directives for each participant account based on unique participant census data provided by recordkeeper

• Delivers investment products to meet specific asset allocation in each portfolio

Managed Account Technology Provider (iJoin)

• Expresses Asset Manager’s investment directives and builds individual portfolios

• Enables Plan Advisors to assist those participants wishing for education and guidance

Recordkeeper – Receives specific instructions from Managed Account Provider and implements individualized portfolio for each participant without any engagement from participant

Nexus338 – Serves as the ERISA 3(38) fiduciary manager on all participant iGPS portfolios