Personalized investment strategies and retirement plans have often seemed out of reach and complicated for the average American worker. The challenges ranged from prohibitive costs and inaccessibility to the sheer investment of time and effort required. With IGPS, those days are firmly in the rearview.

How Does iGPS Work?

iGPS is located at the intersection of technology and personalized financial planning. Its primary feature allows it to be configured and launched as the plan’s default option (or QDIA). What does this mean for your clients?

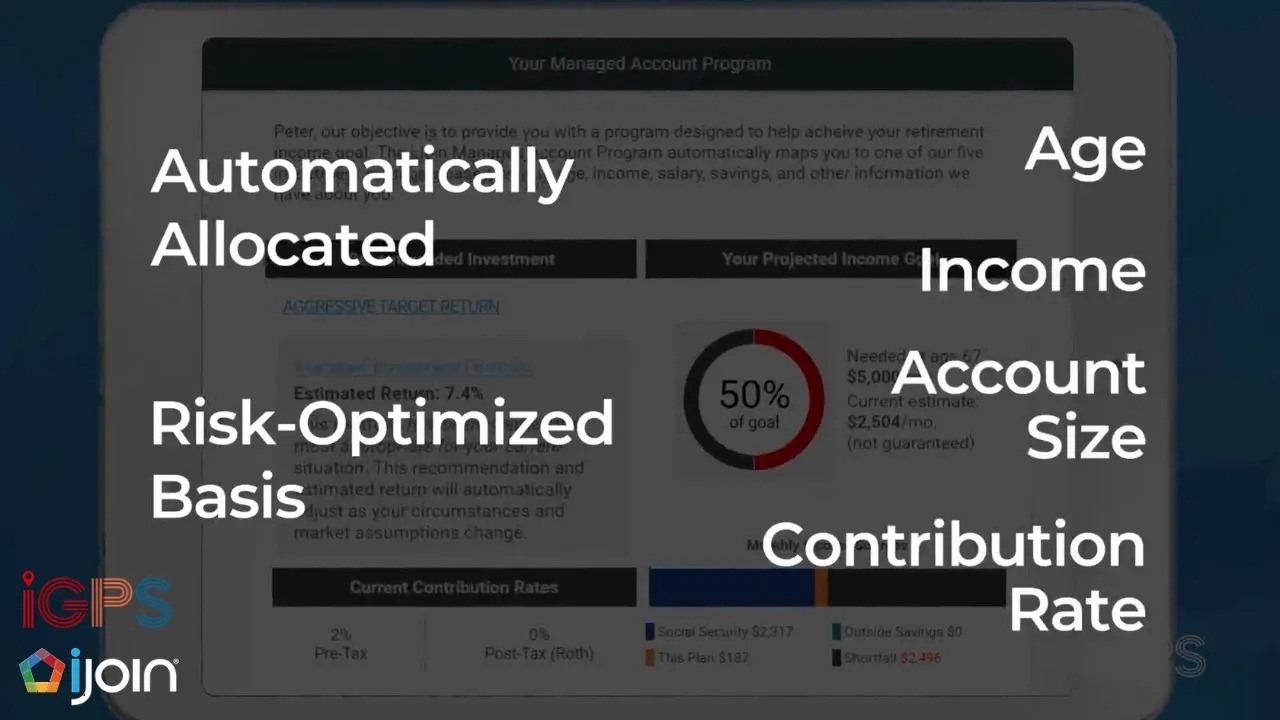

- Automatic Enrollment: Once iGPS is set as the QDIA, participants get automatically enrolled. This takes place after the stipulated notice period, and participants can opt out if they choose. Participant portfolios are risk-optimized based on age, income, account size, and contribution rate.

- Real-time Communication: Post-enrollment, iJoin sends email notifications to relevant stakeholders — the payroll provider, plan sponsor, and, notably, you, the financial advisor. These emails communicate any changes indicated in the submitted data.

- The Personalized Retirement Picture (PRP): Participants receive a concise report detailing their retirement goals, prospective monthly retirement income, and the variables that inform these outcomes. The platform recalibrates its goal assessment every quarter based on updated participant information. If this revised data signals a need for changes in investment allocation, iGPS will provide a refreshed PRP for you to discuss with your client. This is just one of many benefits that iGPS presents to advisors.

The dynamic nature of iGPS ensures that personalized financial planning isn’t just a one-time task but a continuous process tailored to individual needs. So, financial advisors, the future of personalized investment is here — it’s time to integrate iGPS into your offerings.

Watch this Advisor iJoin Demo to learn more about how iGPS is setting new benchmarks in financial advisement!

If you are a participant or a plan sponsor, watch this video!