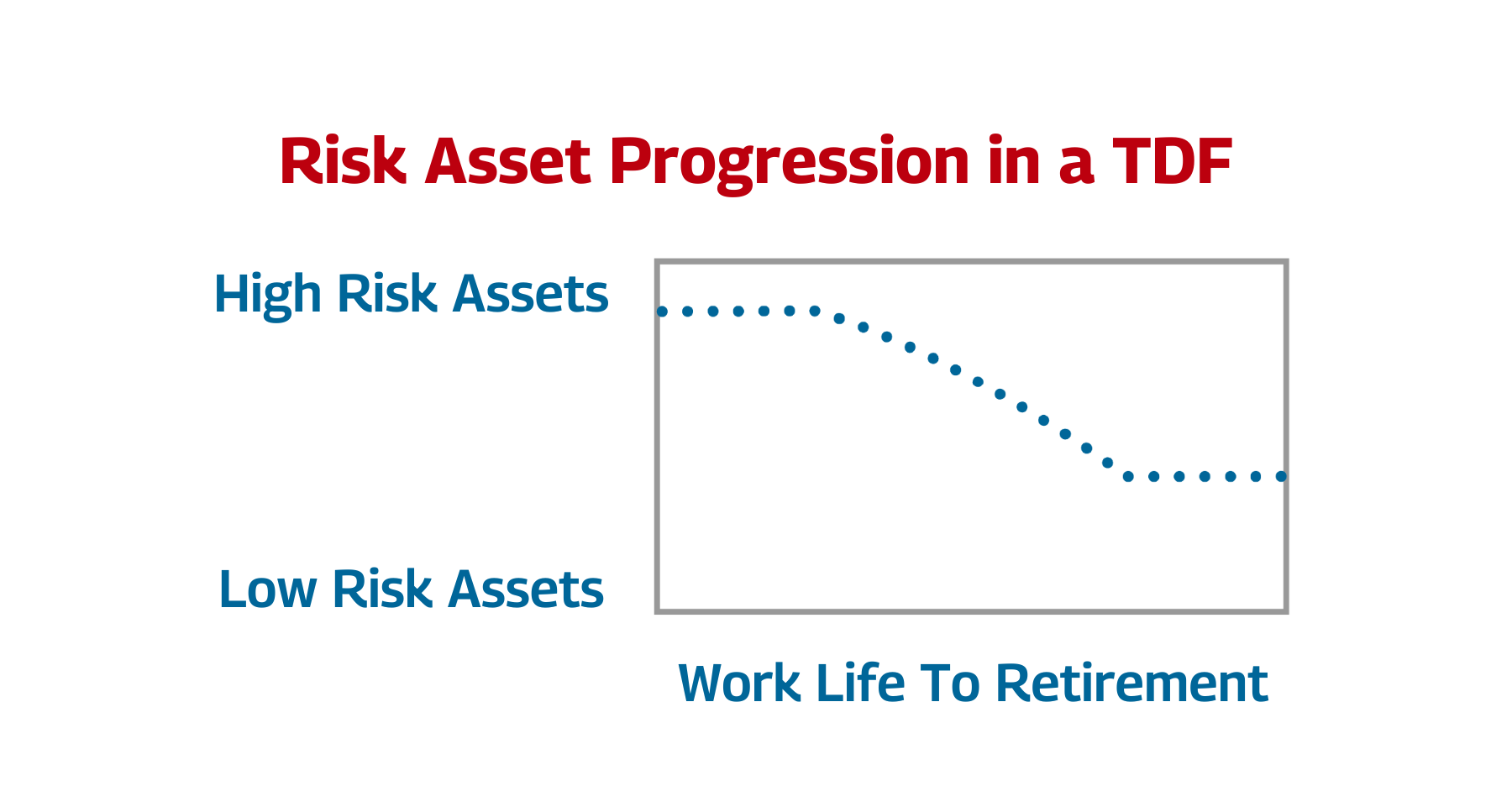

The idea is that a target date fund starts out life for the youngest group of employees, 25- or 26-year-old individuals, at the highest level of risk assets, such as stocks. Over one’s lifetime, as one gets older and gains more assets in their portfolios, the amount of high risk assets reduces for a number of reasons. Most often quoted for reduced risk assets is the inability for you to make up losses as you get closer to retirement because you don’t have another 30 years in the workforce. Target date funds were an easy, logical, simple way to invest participant money.

Additionally, over the last 20 years, there have been a lot of lawsuits regarding fees, resulting in target date funds fees significantly dropping:

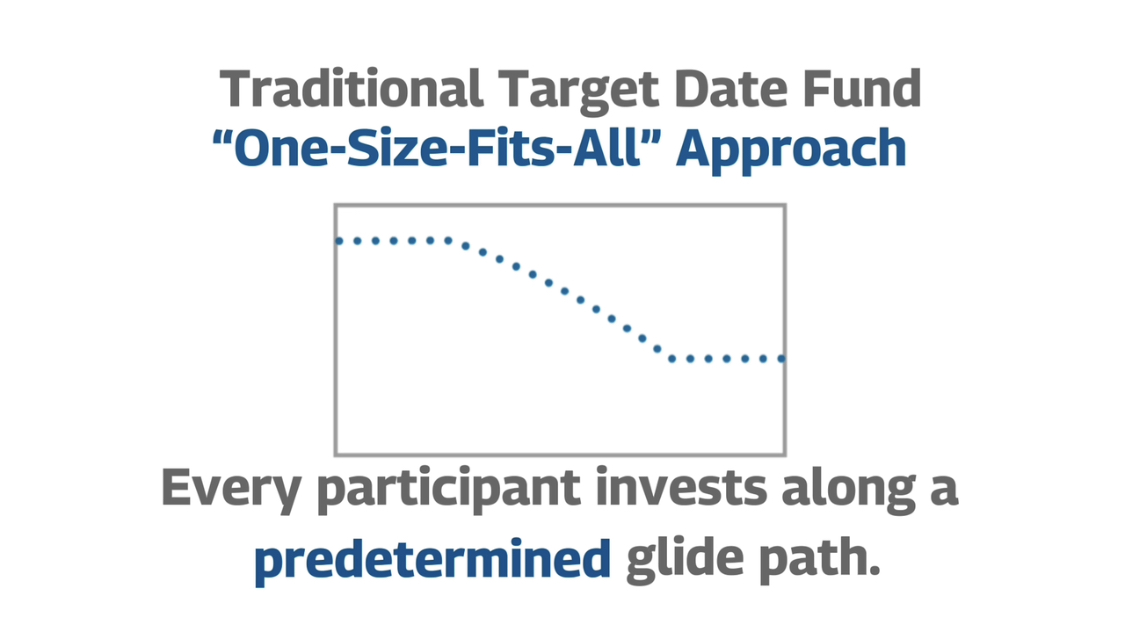

It’s low cost.

It’s easy.

It’s simple.

But the problem with target date funds is that five-year cohorts are all invested in the same target date – men, women, lots of money, no money, making lots of contribution, making no contribution, good saver, bad saver – it doesn’t matter, you’re all lumped into one.

The same way from high equity to low equity, from high risk to low risk, regardless if it is right for you or not.

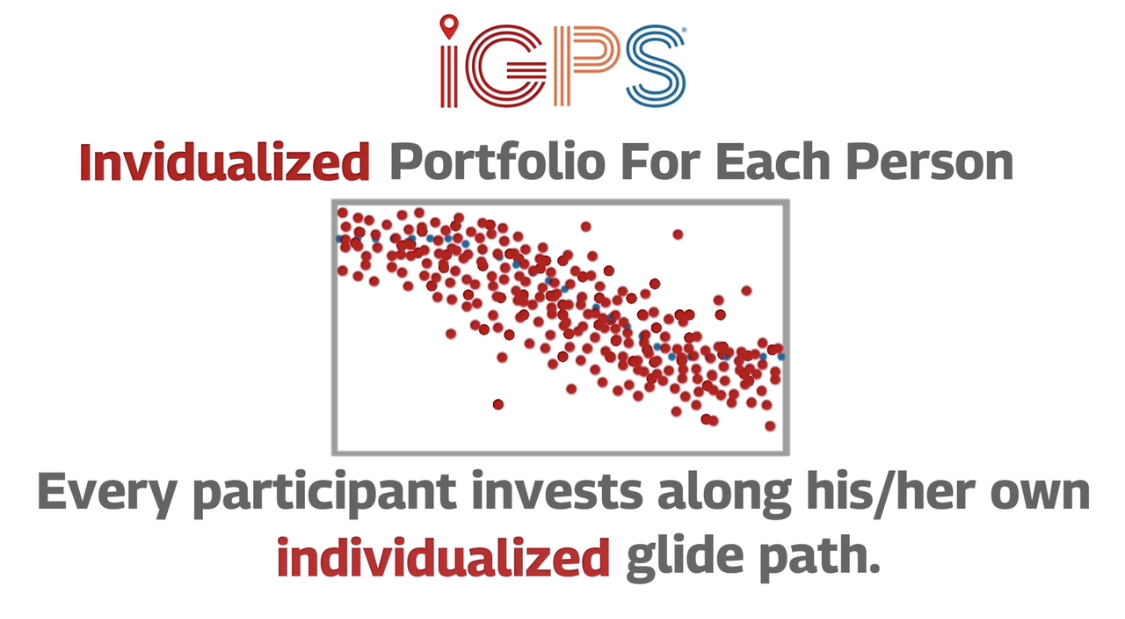

Fast forward 20 years with technological advancement and many other things, target date funds are sort of something of the past. Today, there are ways that we could use participant data to personalize a target date just for you.

#iGPS #retirement #retirementsavings #401k #tdf #targetdatefund #personalization #glidepath #investment #portfolio