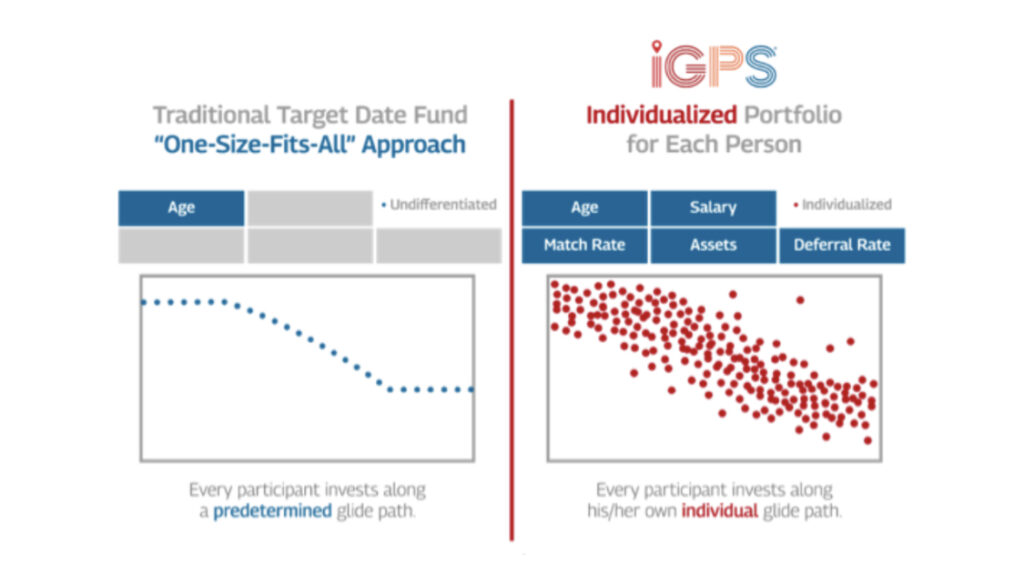

iGPS is a personalized target-date fund solution, which relies on workers’ individual data such as age, income, savings rate, employer match rate, account balance, and projected Social Security income.

This enables us to build an individualized portfolio for each worker rather than placing everyone on the same glide path as in TDF 1.0. As individual data changes over time, for example, wage increases, contribution rate changes, and account balances increase, individual portfolios responsively adjust and realign to reflect the new data quarterly. iGPS uses a suite of cost-effective Target Date Funds as a portfolio-building blocks. Each worker’s portfolio could be comprised of two to three Target Date Fund vintages to calibrate a personalized portfolio. Using TDFs as building blocks is an efficient method to express TDF 2.0.

Each target-date fund is made up of investments in different asset classes, representing a diverse group of industries, economic sectors, investment styles, and risk levels. iGPS asset allocation algorithm strategically blends Target Date Fund vintages to seek the highest return base on a prudent level of investment risks, to personalize workers’ portfolios based on their individualized factors.

In conclusion, TDF 1.0 has been a significant and important development for participants to save and invest their retirement plan contributions. For the first time, workers could gain access to multi-asset portfolios that align with their general age group so that their portfolios would become increasingly risk-averse as they approach their average retirement age. This is a blunt instrument to retirement investing. No worker is average, and a group of idiosyncratic workers should not be defaulted into the same TDF vintage simply because they were within a five-year cohort.

With the advancement in information technology and the availability of participant-specific data from record keepers, TDF 2.0 is a game-changing solution.

It is surgical in personalizing a portfolio for each worker and more responsive in portfolio alignment as personal circumstances change over a worker’s own lifetime. Informed, intuitive, and individualized, iGPS is simply a smarter alternative to TDF 1.0.