The Congress, on May 6, 2021, issued a letter[1] to the GAO, stating

“[t]he employer-provided retirement system must effectively serve its participants and retirees, and we are concerned certain aspects of TDFs may be placing them at risk. TDFs are often billed as set it and forget it investments, yet expenses and risk allocations vary considerably among funds. The millions of families who trust their financial futures to target-date funds, need to know these programs are working as advertised and providing the retirement security promised.”

The GAO is expected to respond to 10 concerns/questions listed in the letter. Many of the concerns and questions involve blanket allocation of risk assets as invested workers approach retirement. One question posed is

“[w]hat steps has the U.S. Department of Labor taken to ensure that plan sponsors appropriately select and use TDFs and that sponsors provide appropriate information and education about these funds to plan participants?”

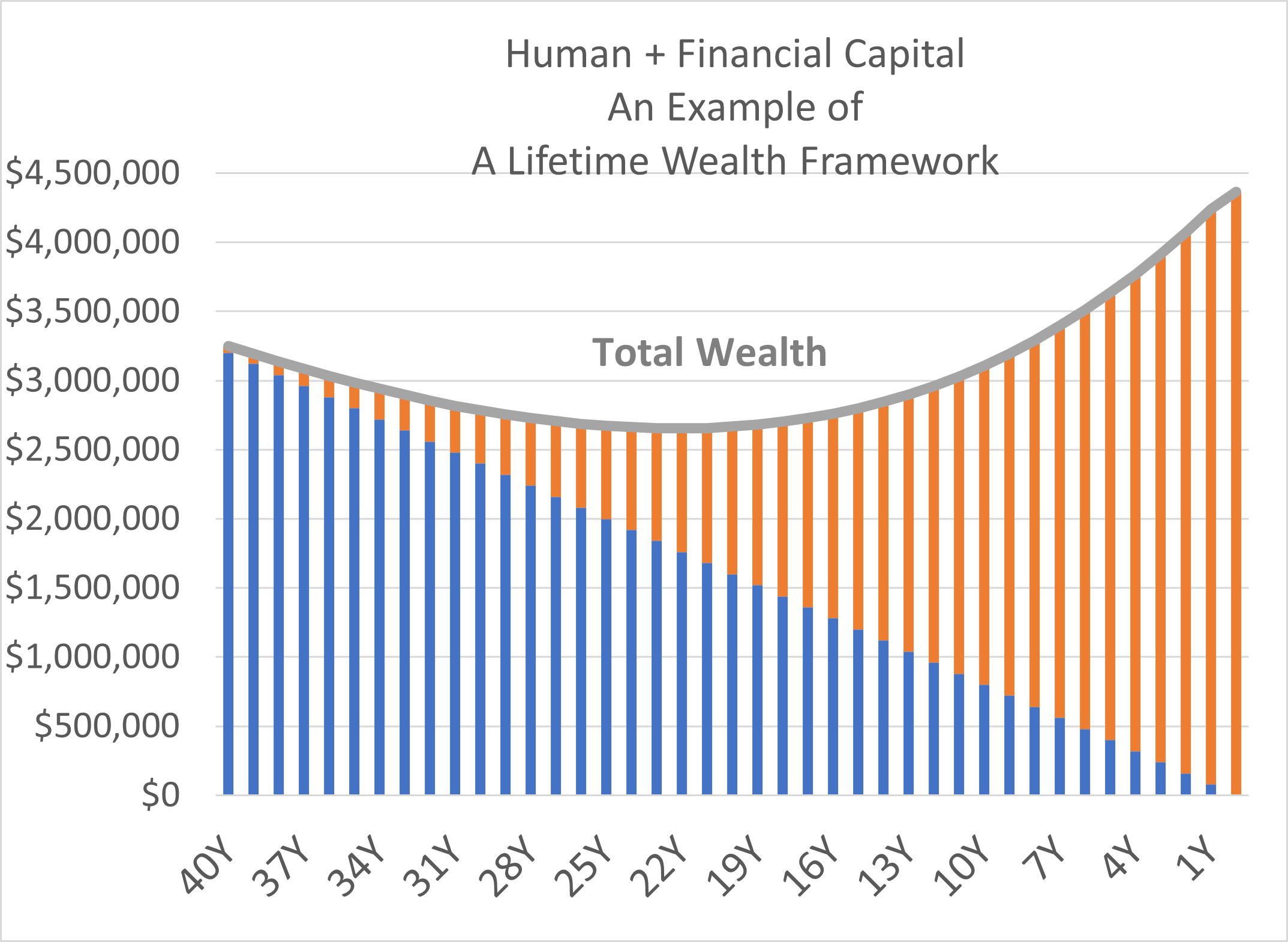

In their paper[2] published on April 6, 2007, “Lifetime Financial Advice: Human Capital, Asset Allocation, and Insurance” Ibbotson, Milevsky, Chen and Zhu laid out a theoretical lifetime investing framework. The authors posited that a person’s total wealth is made up of two components: human capital and financial capital.

Human capital is the present value of all anticipated earnings over one’s remaining lifetime. When we are young or starting out in our careers, most, if not all, of our wealth is made up of this relatively low risk (compared with common stocks) asset, almost like a bond. As such, it makes sense that we can and should take on higher risk when investing our financial assets, such as contributions to our retirement accounts. Over our lifetimes, as our human capital gradually erodes, our financial assets represent an increasing portion of our total wealth. As more and more low risk human capital is depleted, allocation to low-risk assets will need to gradually increase to balance the overall risk of our retirement portfolio as we approach retirement age and beyond.

This total wealth framework is the basis for all lifecycle or target date fund (TDFs) portfolio construction. A TDF starts out at the highest point in risk assets and gradually de-risks the portfolio over time until retirement age 65 (a “to”-glidepath) or beyond (a “through”-glidepath). The 2006 Pension Protection Act introduced Qualified Default Investment Alternatives (QDIA[3]) for employers to gain fiduciary relief to invest defaulted employee contributions – a safe harbor. TDF is one of the three eligible QDIAs and the other two are static risk-based multi-asset portfolios and managed accounts. Since then, TDF has become the dominant default alternative in retirement plans, and much of it is due to its simplicity and low cost.

The current state of the industry is that all off-the-shelf TDFs are investing and solving the retirement needs for that illusive “average” participant, and thus, they use national worker averages as input assumptions, such as the participant’s income, plan assets, contributions, outside assets, etc.

For example, an off-the-shelf 2040 TDF vintage would:

- treat all defaulted participants born between 1973 and 1977 (5 years) the same regardless of their personal factors (wealth, savings, contribution, account size, etc.),

- apply the national average of each input factor in constructing a portfolio to satisfy that “average” participant among an imprecise 5-year cohort, and

- assume every employer group of plan participants in every economic condition, location and industry would be satisfied or appropriate with the same risk-based glidepath.

After all, one should not expect an off-the-shelf TDF series to be responsive to any one group of employees’ personal factors or be able to personalize portfolio construction to any one participant.

In the February 2013 release of the DOL’s Target Date Retirement Funds – Tips for ERISA Plan Fiduciaries[4], the first Tip for plan sponsors and fiduciaries suggests that

| “[y]ou should consider how well the TDF’s characteristics align with eligible employees’ ages and likely retirement dates. It also may be helpful for plan fiduciaries to discuss with their prospective TDF providers the possible significance of other characteristics of the participant population, such as participation in a traditional defined benefit pension plan offered by the employer, salary levels, turnover rates, contribution rates and withdrawal patterns.” |

ERISA[5] states that “the primary responsibility of fiduciaries is to run the plan solely (emphasis added) in the interest of participants and beneficiaries and for the exclusive purpose of providing benefits and paying plan expenses.”

To truly meet the sole interest doctrine, the ideal would be to personalize each participant’s retirement portfolio on a constant basis. Fast forward 10-years, because of advancement in IT and years of fee compression, recordkeeping level participant data can be made available to asset managers to build a TDF for each individual participant. This personalization at scale brings the costs way down as compared to what traditional managed accounts would charge for personalization.

The next generation of default investing as a QDIA is to personalize the current TDF solution where each defaulted participant will have portfolio managed based on his/her unique census and financial data available on the recordkeeping platform. Instead of using national averages, the actual participant-specific data would be used to personalize portfolios, This new generation of solution leverages the foundation of a manage account through connecting with recordkeepers for participant data while maintaining a low cost, low engagement personalized solution for all defaulted participants. This is personalization at scale.

And this is exactly what we set out to do…